Your offers have real meat on the bone and should be considered. They know now that you are a real contender. When a buyer gets a preapproved mortgage from a lender, it sends a clear signal to the seller. Now that you know what the difference is between prequalified mortgages and preapproved mortgages, you have to decide which route you’ll go as you embark on your homebuying process. Preapproved Mortgages: Which Is Best for You?

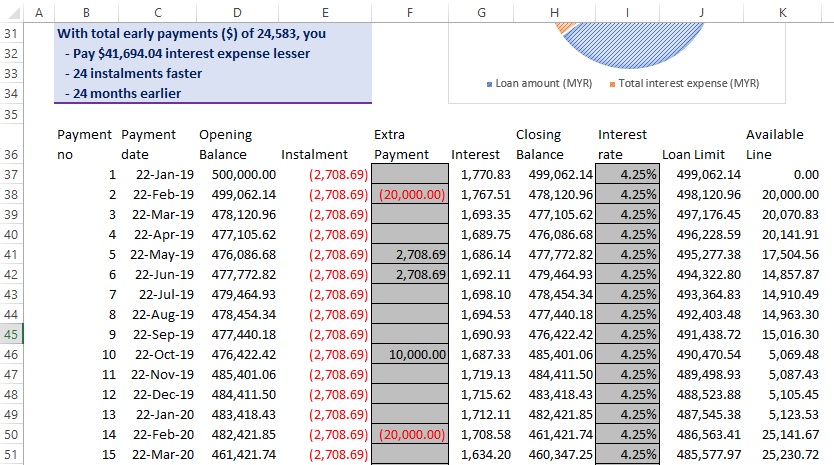

Tax returnsPay stubsW-2 for several yearsLoan informationInformation about other mortgages (if applicable)Credit reportAnd other pertinent financial information Here is a list of documents that you typically have to provide lenders to for mortgage loan preapproval: The bank will want to see proof of your income and debts. The mortgage preapproval process is fairly in-depth. And if you want to, you can apply for mortgage preapproval online. There isn’t a requirement to use a particular lender. Getting preapproved for a mortgage shows that you aren’t playing any games.

#PREQUALIFY HOME LOAN CALCULATOR HOW TO#

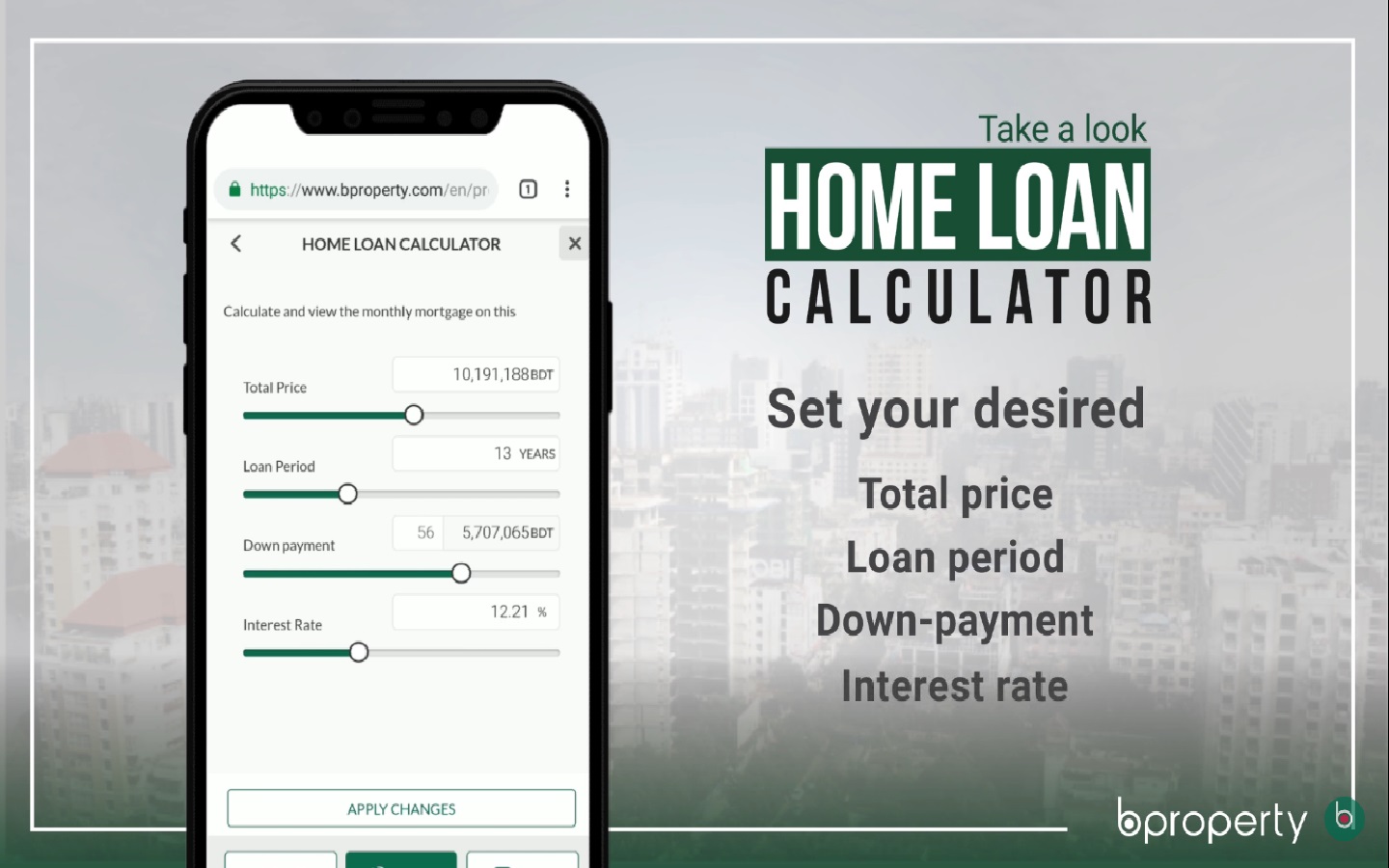

But if you are serious about buying a home, you might want to learn how to get preapproved for a mortgage. It gives you an idea of what is out there and helps you start planning.īeing prequalified for a mortgage is a good starting point if you are on the fence and you’re trying to decide if you want to rent or buy a home. A prequalification from a mortgage lender tells you the types of loans that are available, how much it may be willing to lend to you and what your payments could possibly be.īut a prequalification is not a binding agreement. It’s like a fact-finding mission and does not signal to sellers that you are a true buyer. Getting a prequalification on your home mortgage is simply a basic step. For help with a mortgage, consider finding a financial advisor. Preapproval requires a credit check, a mortgage application and an estimate of your own down payment. Preapproval is actually a follow-up process that is much more involved and often costs money.

#PREQUALIFY HOME LOAN CALCULATOR FREE#

Prequalification is generally a quick, free process where a bank takes your financial information and lets you know generally what your loan will look like. I'm an Advisor Find an Advisor Search Email FacebookTwitterMenu burgerClose thinShould I Get Prequalified or Preapproved for a Mortgage? - SmartAssetUpdated on May 16, 2023Written by Hank ColemanShareĭespite sounding identical, a prequalified mortgage is not the same as a preapproved mortgage.

0 kommentar(er)

0 kommentar(er)